In the fast moving solar PV operations and maintenance (O&M) market, one constant voice is Cedric Brehaut of SoliChamba. Cedric is the well-known speaker and author of the industry’s most comprehensive reports on PV monitoring and O&M markets. These reports are published by GTM Research.

To get an insider’s view on the current state of the O&M market, Solar O&M Insider talked with Cedric along with industry veteran, Laks Sampath of Alectris.

Listen to the podcast for the full interview. It includes:

Listen to the podcast for the full interview. It includes:

- Global rise of third party solar O&M service providers

- Build vs service models in the maturing O&M market

- Refining definitions for solar operations and maintenance

- Major trends shaping the solar O&M market

- Competition heating up in solar O&M market

- Delivering value to solar investors and owners

- O&M in emerging solar markets

- Building and Airlines – Market models applicable to solar O&M

- Insights into November 2016 solar O&M report

Global Rise of Third Party Solar O&M Service Providers

Global Rise of Third Party Solar O&M Service Providers

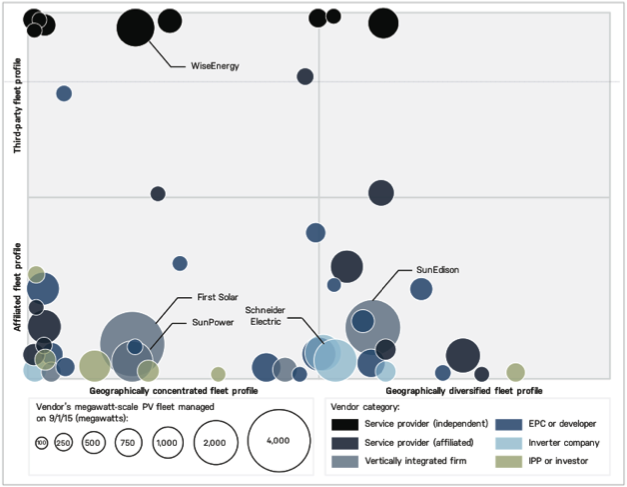

Megawatt-Scale PV O&M and Asset Management 2015-2020: Services, Markets and Competitors analyzed 76 vendors, managing nearly 41 gigawatts of PV utility scale plants.

This report showed independent service providers or ISPs who were once marginal players now capturing significant levels of market share related to O&M and asset management services.

It also showed the emergence of the ASPs, or affiliated service providers. These are organizations active in the solar market who have created a service business for solar O&M. This could include installation firms, developers, manufacturers or other service providers now doing O&M.

“The most typical example is in Europe where you had EPCs and developers that saw a reduction in activity, because as you know, most European markets have slowed down significantly when it comes to new development and new construction. And so these firms separated their O&M business so that it would stand on its own. In case the EPC or developer parent goes bankrupt, there’s still a standalone O&M business that can continue because this is recurring revenue. That was one of the drivers in Europe,” explained Cedric Brehaut of SoliChamba.

“With ISPs, the independent companies, what I see is that they’re more local to specific markets. Most of them are specialized in one market. Some of them have a crossover in different European countries, but usually, it doesn’t go beyond Europe. In that regard, I would say Alectris is a bit of an exception. But overall, that’s how I would say that the landscape is laid out.”

Major Trends Shaping the Solar O&M Market

Major trends shaping the market include:

- Awareness – More awareness on these topics of O&M and asset management and more focus on from the investors, from the developers and from EPCs as well.

- Scale – Increased scale and density, particularly in markets like the US where there’s continued and strong growth and in some of the emerging markets in Latin America as well. Increased scale and density helps the vendors because the more plants you have in a given territory, the more efficient you can become in serving these plants and the more you can optimize your costs.

- Maturation – More plants exiting their initial warranty. Typically, O&M contracts are tied to a certain period of time that often matches the initial warranties. when the warranties are gone, there usually comes a time when the owner has a choice of either extending the contract with the initial provider, often times the EPC or the developer, or switching to a third party provider.

“So this is really a clear opportunity and I think it is going to increase. Mathematically it is going to increase because as the number of new plants has been increasing these last few years, you take that same growth curve and you shift it by two to five years, depending on the length of the warranty, and then you have warranty exits that follow that same growth curve. So I think these factors are definitely positive for independent vendors in particular,” explained Brehaut.

Delivering Value to Solar Investors and Owners

As a more sophisticated and structured approach emerges in the solar O&M market, third party providers are able to deliver more value to solar investors and owners.

“The first value is choice because talking to different owners and investors, maybe up to two years ago and maybe even last year, they wouldn’t have even looked for an alternative provider to the EPC, “said Brehaut.

“There’s still an advantage for the EPC because they can offer let’s say one throat to choke type of service where there’s not going to be any finger pointing, particularly when it comes to warranties, so they can sell that as an advantage. They know the plant well because they designed it and built it. But at the same time, ISPs and ASPs are increasingly competitive in those situations, especially when there’s an RFP process with competitive bids.”

Investors and owners now have more choice from increased competition, meaning that providers are going to fight to offer the best deal.

“I think there’s a risk that there could be also a downside to that if the competition goes ‘too far’ and providers go to service levels that are not sufficient to protect the asset and to ensure its performance. I don’t think we’ve gone there yet, but we’re certainly seeing price levels, especially in the utility scale segment, that are a little worrisome and where one might wonder if the budgets are sufficient.”

Discussing benefits to solar PV owners, Laks Sampath of Alectris compared the role of the service provide to the building industry.

“So let’s look at the building industry, constructing malls or office complexes compare that with similar asset managers like myself,” said Sampath.

“There is a lot of similarity between these two industries. It involves developers, investors and EPCs. The project is developed, financed and then constructed. Upon completion the EPCs issues warranties. Once the building is done and it’s handed over to the owner, there is somebody called a facilities management company that comes in and takes care of the building.”

The warranties are then administered by the facilities management company. Sampath affirms this is where the ISPs and the solar industry need to play a part simply because EPCs are structured to build and move on.

“So in a building, let’s say an HVAC goes out. If the HVAC goes out, the owner doesn’t go after the EPC that built the building. The facilities management company addresses that directly with the Carrier or the Trane, whoever’s equipment it is. Similarly, we in the ISP side or the ASP who will now deal with the inverter manufacturer or the tracker manufacturer to address issues or the module manufacturer to address issues,” outlined Sampath.

The key to all of this is to be able to provide performance guarantees.

“So a little bit more budget on the operations side will actually reduce the overall maintenance cost. I’ll give you an example. We just commissioned 2.3 megawatts in Wisconsin for a large conglomerate. We also monitor the project and have the operations and plant maintenance contract. This allows the customer to hold the EPC’s feet ‘to the fire’ and also our ‘feet to the fire’ because, we commissioned the plant. If we come back and say, well, this plant wasn’t built right, we don’t have such excuses. We have to say this plant is according to what was designed and so we can provide those performance guarantees. That’s where ISPs and ASPs can really provide value to an investor,” concluded Sampath.