Lessons learned in the Italian solar secondary market help investors utilize due diligence phase operations and maintenance expertise to hedge risk and increase long term profitability of their asset acquisitions.

By Emanuele Tacchino, Business Development, Western Europe & Middle East, Alectris

In the vibrant Italian solar photovoltaic (PV) secondary market the financial benefits of tapping operations and maintenance counsel during acquisition due diligence are being realized by investors. The strategy outlined here is applicable to any global region where the solar PV secondary market is robust and investors are looking for ways to hedge risk and increase the long term profitability of their acquired assets.

In the vibrant Italian solar photovoltaic (PV) secondary market the financial benefits of tapping operations and maintenance counsel during acquisition due diligence are being realized by investors. The strategy outlined here is applicable to any global region where the solar PV secondary market is robust and investors are looking for ways to hedge risk and increase the long term profitability of their acquired assets.

The solar photovoltaic (PV) landscape in Italy continues to be dominated by a large number of mid-size grid connected plants, with the majority of them in operation for more than two years.

According to Italian entity GSE’s reports (Gestore dei Servizi Energetici) there are more than 5,000 PV plants smaller than 3MWp in operation and approximately 2,000 plants of a bigger size, for a total estimated capacity of 7GWp.

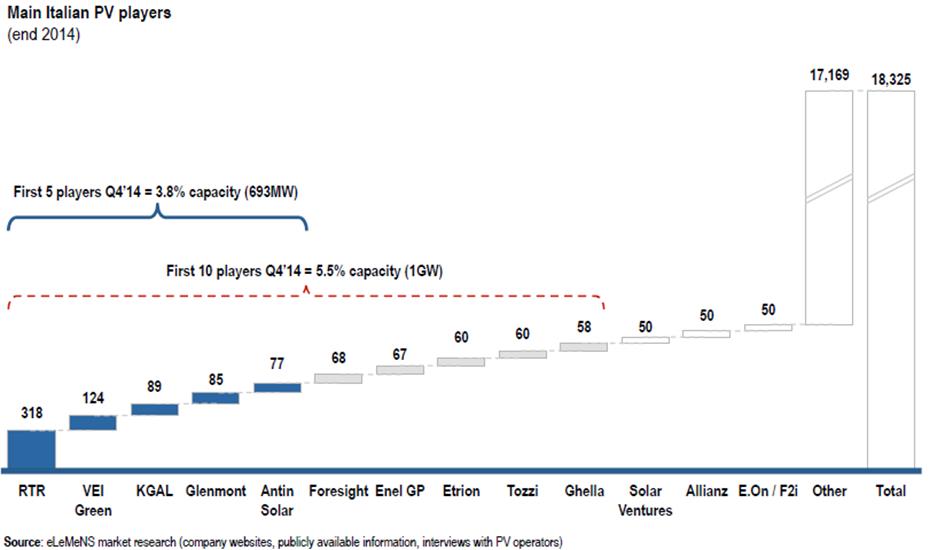

The five top solar PV portfolio companies own approximately 3.8% of the total installed capacity in Italy. The total of the first 10 players reaches 1GWp. The market is highly fragmented.

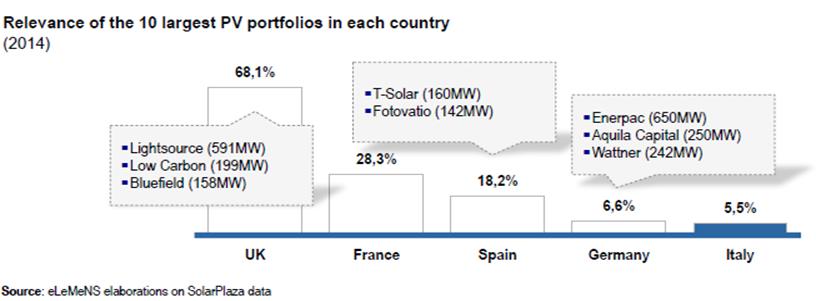

For a comparison, the other EU countries, with the “young” UK PV market on top, show completely different values in terms of relevance of the top PV portfolios. A clear consolidation trend in these markets follows the level of maturity of each respective country. For example, the UK market started from the very beginning as a “PV learned” market, with various big funds involved that have played a significant role in the development of the more aged markets (Germany, Spain, Italy).

The results point to solid conditions and potential for the development and growth of a similar consolidation in the Italian solar PV secondary market, which is currently happening.

Even after the recent legal and incentive changes (Spalma Incentivi among others) affecting solar PV plant IRR, the patience levels of plant owners and subsequent operating cost restructuring involving primary stakeholders (O&M servicer, Asset Managers) the acquisition of an operating PV plant in Italy at the right conditions still allows interesting returns for investors.

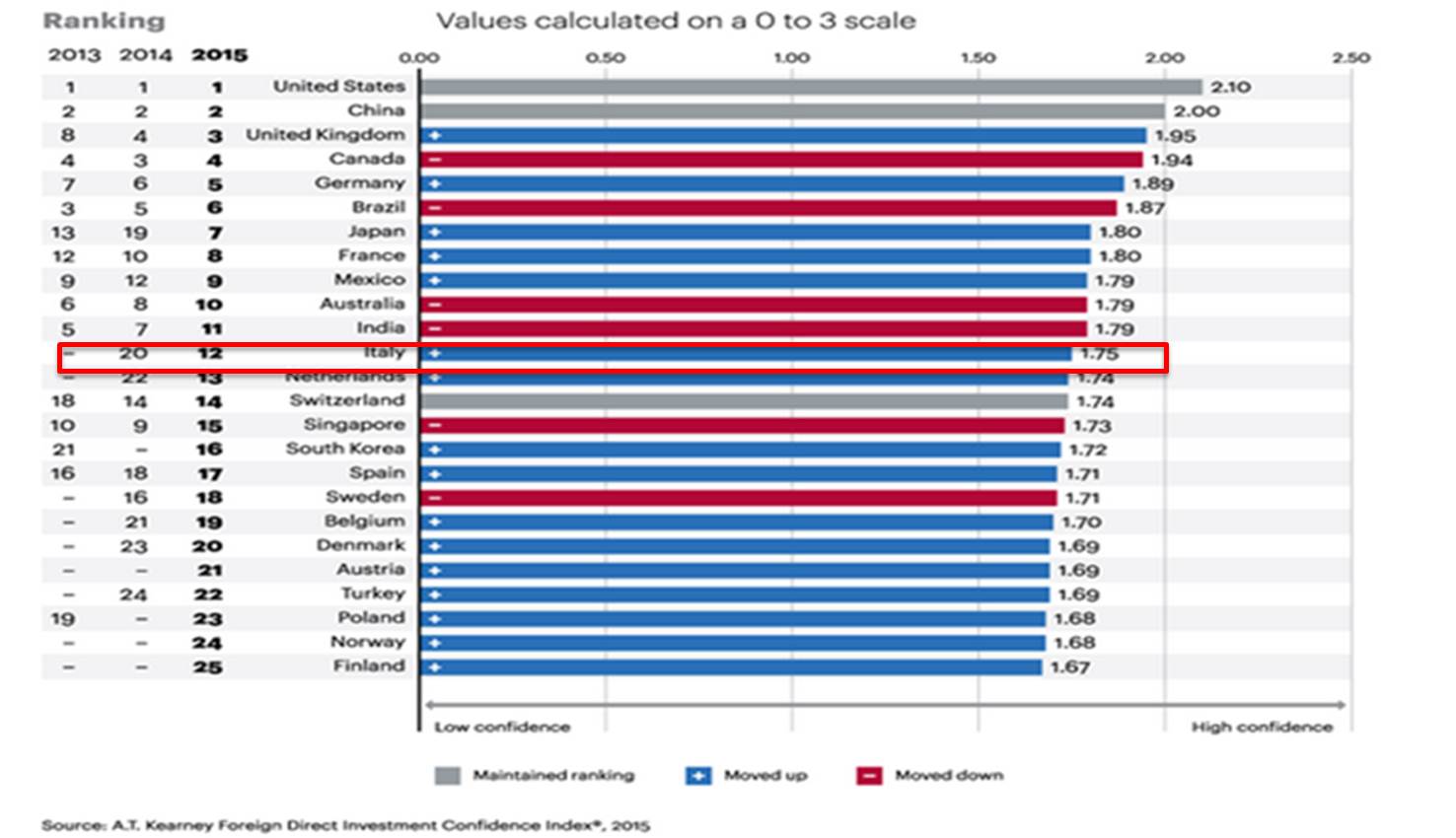

In addition, the renewed country political stability has allowed Italy to gain more appeal for foreign investments (Source: AT Kearney Foreign Direct Investment Confidence Index 2015, Italy from 20th place in 2104 to 12th place in 2015).

A solar PV plant secondary market acquisition is hugely different than acquiring a PV plant in development. Investors acquiring operating PV plants can assure strong returns with the extensive knowledge of the right partners during due diligence (DD).

Due diligence technical service providers should take a “deep dive” into the solar PV plant targeted by the investor. Services to ensure future energy generation should go beyond simply verify documents and performing basic visual inspections. These services performed by typical technical consultants have the potential to overlook key details professional operations and maintenance (O&M) service providers would identify in the plant’s construction and performance history. If investors want to be assured of future performance, they should contract with a reputable solar operations and maintenance firm to provide a high level and detailed assessment of the targeted PV plants.

If investors allow the O&M provider to run the technical DD coupled with guarantee performance after acquisition, this strategy will result in big cost savings. For example, if due diligence is conducted by a third party and a second O&M provider is appointed after acquisition, this provider will have to again run a technical analysis to secure their risk. So a technical DD will need to be done twice with the cost thus incurred doubled.

A qualified solar O&M provider should provide the following DD services for investors of operating solar PV plants:

- Verify status and functioning of all the equipment in place in the targeted plant. Conduct verification in the field.

- Identify the plant’s defects or performance weaknesses

- Suggest cost effective corrective or improvement actions

- Highlight the relevant technical upside/downside of the plant to the investors, for a better negotiation with the seller

- Properly serve the plant as O&M service provider after the acquisition

- Grant the relevant typical plant performance’s KPI guarantees during operation

It is clear that such partner, the professional O&M service provider, shall grant a completely different commitment on the assessment and the relevant findings of his in depth analysis since he shall also be required to provide Performance Guarantees (typically Performance Ratio and Availability) in case he is appointed as O&M service provider to the inspected plants after their positive acquisition.

For the majority of solar assets, high level technical and legal DD has been conducted during several phases of the asset’s life cycle. The investor’s risk in the secondary market is heightened unless detailed equipment reviews are performed. This process is fundamental for the security of the investment:

- Operating PV plants, particularly aged assets (more than 5 years old), have been assessed by other legal or technical advisers during financing at the time of construction and/or during refinancing.

- The risk for the investor related to legal due diligence (critical issues or red flags), technical documentation and the “as built” with the existing plant, or the compliancy with applicable law and regulatory is quite limited (excluding full equity plants, that have not been yet assessed by any technical consultants), and are typically remedied without incurring dramatic additional cost.

While the legal or high level technical risk is thus quite limited or in some way “controlled,” analysis of plant equipment becomes critical. Given the value of the investment the imperative becomes the reduction of any kind of operational surprise and future corrective costs after plant acquisition. Knowing the weakness of the targeted plants before acquisition will allow the investor to save money on the acquisition itself.

“I appointed Alectris to conduct the technical due diligence for a 4.2 MWp plant in Italy on the secondary market, where I needed a professional partner to quickly and completely assess this solar PV plant in the field. Alectris has proven to be the right partner, acting in a quick and accurate manner, and adding fundamental understanding related to the real value of the plant we were evaluating to acquire. Moreover Alectris gave me quick and substantial answers to questions which were normally out of their scope,” said Wolfram Misch, Technical Director, New Power Systems GmbH

Investor risk can be minimized by following critical in field DD evaluation steps. This evaluative process provides a full plant assessment, executed in phases of increasing accuracy. This approach also minimizes investor expense. It is assumed the operations and maintenance DD runs in parallel to those reviews of legal, tax and accounting.

Recommended solar PV operations and maintenance due diligence scope of work includes:

Phase One

As Built vs Detailed Engineering and EPC contract analysis

- PV plant layout, Flash Tests, Wiring plan, Electrical drawings, Design documentation

Compliancy of the Plant with safety regulations and applicable norms

Complete Plant’s equipment check on site

- PV modules (string connections, string boxes, broken/defect modules)

- Inverters (operation & state, existence/operation of DC/AC surge arresters)

- DC cables (state, sufficient holding)

- Mounting system (tilt position, state)

- Transformers/MV part (MV UPS, LV UPS, LV main board)

- Trackers (position-orientation & operation, stability & static efficiency)

- Security system (cameras, beams, magnetic contacts, DVR, motion detectors, optic fiber..)

- Monitoring system (weather station, pyranometers, GSE meters)

- Communication (equipment, quality of internet connection)

In depth Thermography

- Thermographic check of all Modules, all Inverters and all String Boxes

Phase Two

This phase should be activated if and when the plant acquisition is probable, after it has achieved clean legal DD and no major red flags:

Additional in depth measurements and checks:

- Junction boxes (strings’ DC fuses, measurements of Voc, Isc or Impp, V-I curves)

- Inverters (parameters/limits, AC/DC conversion)

- AC/DC cables (measurement of insulation level)

- Trackers (efficiency & state of motors, encoders)

- MV part (MV switch, MV UPS, transformer)

- Pyranometers (verification of consistency of measured values)

- Communication (data transfer, connection stability)

Each phase investigative report should summarize the data and findings and provide a complete overview of the operational status of the installation.

Specific qualitative and quantitative factors have to be analyzed:

- Inverters dimensioning

- Cablings’ dimensioning

- Transformer’s dimensioning

- Shadowing effect

- Sorting of modules

- Performance ratio of the plant (PR of the last year as well as monthly values)

- Availability of the plant and reliability of the tracking system

- Energy deviation between real values & base case scenario

- Irradiation deviation between real values & base case scenario

- Security system

Upon completion of this scope of work the entire plant operation and performance has been evaluated and will provide investor confidence to move forward with the plant acquisition. By tying the initial solar O&M provider services to the same firm as long term care of the asset, the investor can gain additional value from this process to secure long term profitability.

When investors allow the O&M provider to run the technical due diligence (DD) coupled with guarantee performance after acquisition, this strategy will result in big cost savings.

1. For example, if due diligence is conducted by a third party and a second O&M provider is appointed after acquisition, this provider will have to again run a technical analysis to secure their risk. So a technical DD will need to be done twice with the cost doubled.

2. By implementing the expertise of a qualified O&M provider during DD the investor has grounds to hold the provider to anticipated performance benchmarks after acquisition. Increasing the credibility of DD by the use of O&M expertise, the investor provides a path for clear liabilities in terms of liquidated damages paid to the investor during operation if the asset under performs, or the cure of any technical deficiencies at the O&M service provider’s cost to avoid such liabilities.

To reach Emanuele Tacchino directly in the Alectris Italy office: [email protected]